Asset Tokenization

Asset tokenization involves leveraging smart contracts and blockchain technology to represent ownership or rights to an asset through a tradable on-chain token. While it typically pertains to the tokenization of financial or fungible assets like company shares or a specific quantity of gold, the concept can theoretically extend to tokenizing anything with monetary value. This makes asset tokenization one of the most promising applications for blockchain technology, potentially encompassing a substantial portion of global economic activity, estimated to be well over a hundred trillion dollars annually.

For those acquainted with the oracle problem, the integration of Web3 applications with the external world introduces security risks and complexities. Asset tokenization, inherently reliant on off-chain information about the world, is no exception. To unlock its full potential, secure oracles play a crucial role in providing markets with reliable information about underlying assets, influencing key processes such as minting, trading, management, and more.

At Primary, our mission is to democratize access to institutional-grade financial products and services. We are confident that blockchain technology can enhance the infrastructure and accessibility of financial services. Our approach blends the best technical advancements with established practices from traditional finance, emphasizing investor protections, transparent reporting, legal compliance, robust product structuring, collaboration with leading service providers, and exceptional client service

To achieve this, we operate with an asset management arm responsible for creating and managing tokenized financial products, coupled with a technology arm dedicated to developing decentralized finance protocols.

What is Asset Tokenization?

Digital asset tokenization is the procedure by which ownership rights of an asset are transformed into digital tokens and recorded on a blockchain. In such instances, these tokens function as digital certificates of ownership, capable of representing a wide range of valuable objects, including physical, digital, fungible, and non-fungible assets. The advantage lies in the blockchain storage, granting asset owners custody control when securely held in their crypto wallets.

The potential of this use case is not only impressive in the long term but is also evident in the current strides toward adoption. Major enterprises such as Boston Consulting Group, ADDX, BlackRock, Deloitte, BNY Mellon, and EY have delved into asset tokenization, recognizing its disruptive capacity across various industries, notably the global securities sector. Furthermore, Microsoft and Vanguard have either announced or initiated projects involving the tokenization of industrial assets and securities. Judging by these developments, asset tokenization stands out as one of the most popular blockchain use cases experiencing tangible adoption in real-world enterprise scenarios.

To grasp the mechanics of asset tokenization and its significance, a revisit to the basics of Web3 technology is necessary. Smart contracts, as secure digital agreements created through computer code and stored on the blockchain, play a pivotal role. In the token issuance process, developers craft a smart contract on a blockchain that associates positive balances with specific wallet or smart contract addresses. This contract also encompasses functions that empower users controlling those addresses to manipulate and update those balances.

At Primary we envision Asset tokenization as the process by which an issuer creates digital tokens on a distributed ledger or blockchain, which represent either digital or physical assets. Blockchain guarantees that once you buy tokens representing an asset, no single authority can erase or change your ownership — your ownership of that asset remains entirely immutable.

Examples of Asset Tokenization

- Real-world asset tokenization, involves converting tangible assets like fiat currency, equities, T-bills, credit, commodities, carbon credits, intellectual property, and fine art into tokens stored on a blockchain. Comparable to traditional bearer assets like gold bullion warrants and house deeds, these tokens are bearer assets, providing the holder with a claim over a physical asset. The distinct feature of physical asset tokenization is its ability to facilitate storage, trading, and utilization as collateral across various blockchain networks.

- Digital asset tokenization, on the other hand, focuses on tokenizing assets existing solely in a digital format on a blockchain network. This is particularly crucial for Web3 applications, addressing use cases such as representing DAO governance rights and managing cross-chain assets. Since these assets are entirely digital, their tokenization on a blockchain allows the owner to possess the asset outright rather than holding a claim on the underlying asset.

- In-game asset tokenization, a subset of digital asset tokenization, pertains to representing in-game assets used in GameFi projects or metaverses, including items like skins, weapons, or in-game currencies, as tokenized assets.

How does Asset tokenization work?

Tokenization integrates origination, distribution, trading, clearing, settlement, and safekeeping into a unified layer, fostering an efficient financial system built on blockchain technology. The creation of tokenized assets involves various steps, such as defining the token type (fungible or non-fungible), choosing the blockchain for token issuance, opting for a third-party auditor to verify off-chain assets, and executing the asset issuance. The decentralized nature of blockchain networks ensures transparent safekeeping, as ownership records of assets are immutable and resistant to tampering, instilling confidence in users regarding the system’s integrity.

The steps involved in the asset tokenization process can vary based on the specific needs of each use case. However, the following are the fundamental steps to be adhered to when tokenizing an asset and incorporating off-chain valuation data onto the blockchain, utilizing Chainlink Proof of Reserve

The first step is to identify the asset that you want to tokenize. This could be equities, commodities, currencies, securities, fine art, carbon credits, intellectual property, or another asset class. Once you’ve identified the asset you want to tokenize, you need to define the type of token that you want to create. You’ll need to consider factors such as the token standard you want to use (ERC-20, ERC-721, ERC-1155, etc.), the number of tokens to be created, the mechanism governing minting tokens, and other custom parameters and rulesets.

The possibilities are endless as tokenization allows for both fractional ownership and proof-of-ownership. From traditional assets like venture capital funds, bonds, commodities, and real-estate properties to exotic assets like sports teams, race horses, artwork, and celebrities, companies worldwide use blockchain technology to tokenize almost anything. However, we have grouped them into four main categories:

- Asset: An asset is any item of value that someone can transform into cash. It’s further divided into two classes: personal and business. Personal assets can include cashand property. Business assets include assets that are present on the balance sheet. Real estate assets refer to physical properties such as land, buildings, or residential/commercial spaces. These assets have inherent value and can generate income through rental or appreciation. Real estate is often considered a long-term investment, providing stability and potential financial growth. Collectibles, on the other hand, are items valued for their rarity, uniqueness, or historical significance. They can include art, antiques, vintage items, or memorabilia. The value of collectibles is often subjective and may fluctuate based on factors like market demand, condition, and cultural trends. Unlike real estate, collectibles are typically movable and may not generate ongoing income. Both real estate assets and collectibles can be tokenized, converting ownership into digital tokens on a blockchain. This process allows for fractional ownership, increased liquidity, and broader market access. Tokenization enables investors to own a share of valuable assets without the need for substantial capital, fostering a more inclusive and flexible investment landscape.

- Equity: Equity (shares) can be tokenized; however, the assets remain in the digital form of security tokens stored online in a wallet. Investors can typically buy shares on a stock exchange.

- Funds: An investment fund is a type of asset that investors can tokenize — these tokens represent an investors’ share of the fund. Each investor is provided tokens which represent their share of the fund.

- Services: A business can offer goods or services as a way to raise funds or conduct business. Investors can use tokens to purchase goods or services provided by the supplier

Subsequently, it becomes essential to determine the blockchain ecosystem for the issuance of tokens. This decision hinges on the unique needs of the particular tokenized asset. Considerations include whether the tokens should be deployed on a public or permissioned blockchain, or if a custom network or rollup framework is preferable for creation.

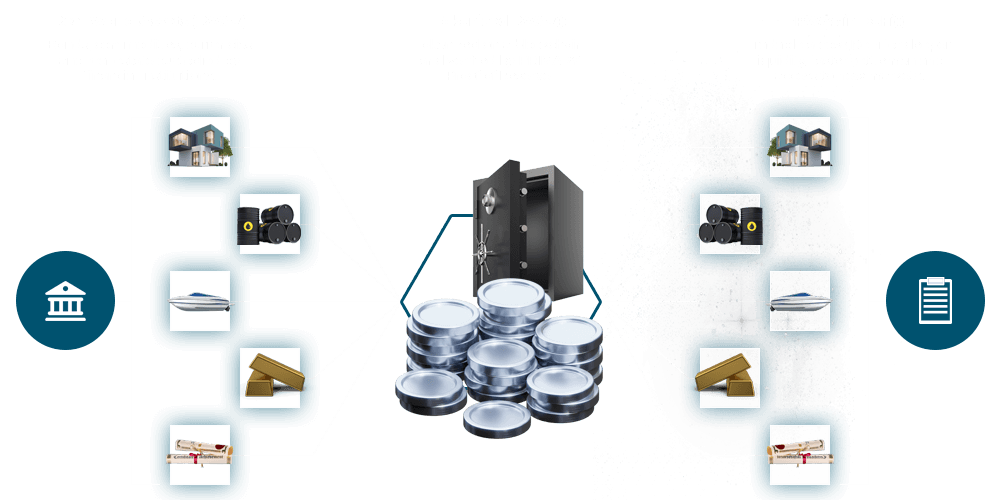

In the context of tokenized assets supported by tangible financial entities like fiat currency, equities, or bonds, collateralization data must be transmitted on-chain from external bank accounts or vaults. This ensures that the tokens possess an equivalent backing of collateral assets. In such instances, third-party validation is crucial to affirm that the off-chain holdings match the tokenized value, providing users with assurance that the issued tokens align with the underlying asset’s value. Additionally, for other asset categories like fine art, data sourced from marketplaces, auction platforms, and assessments by both professional and independent appraisers can be employed to guarantee that the digital tokens accurately represent the value of the underlying assets.

The success of a tokenization initiative hinges on several critical factors, including:

- 1. Security — Paramount in asset tokenization is security, leveraging blockchain technology’s transparency for collateralization verification. For tokenized assets, secure on-chain relay of collateralization data is imperative to maintain sufficient backing, as the decentralized composability of DeFi allows any undercollateralized token to impact the broader ecosystem significantly.

- 2. Automated verification — Asset tokenization’s cost-saving and transparency benefits are realized through the implementation of smart contracts for the automatic verification of off-chain reserves supporting an asset, benefiting issuers and enhancing transparency for users.

- 3. Transparency — As user demand for trust-minimized applications rises, transparency becomes a pivotal element in tokenization projects, assuring users of the integrity and reliability of the system.

- 4. Cross-chain interoperability — Certain tokenized assets require interoperability across diverse blockchain environments to access a broader liquidity pool and engage a larger user base on different platforms.

Benefits of Asset Tokenization

Benefits of Asset Tokenization can be divided into two main groups. Benefits for asset owners and benefits for investors.

From the side of asset owners the main benefits are:

Increased liquidity

Let’s use the example of an individual requiring $100,000 taken out of a condo valued at $1,000,000. This individual may have tokenized their condo into 1,000,000 security tokens, each worth 0.0001%. They might sell 100,000 tokens, instead of selling the entire property and losing its utility as a livable space, thus ensuring a more liquid asset.

Fair prices

Assets with limited liquidity often lack a well-defined market price. Consequently, owners commonly offer incentives, such as illiquidity discounts, to entice buyers, thereby decreasing the asset’s overall value. Asset tokenization addresses this challenge by enhancing liquidity through fractional ownership, eliminating the need for illiquidity discounts. Furthermore, the ability to sell smaller ownership fractions allows owners to set a more equitable market price.

Reduced management costs

When transferring ownership of an asset today, the involvement of intermediaries, often lawyers, is necessary to manage paperwork and establish trust between the seller and buyer. This adds both time and cost to the process. Opting for tokenization of the same asset and utilizing a decentralized platform or marketplace automates several aspects of this process, leading to time and cost savings.

From the investors perspective the main benefits of Asset tokenization are:

Increased liquidity

Taking into account the aforementioned example of a tokenized property, retail investors now have the opportunity to allocate smaller sums of money into real estate. Investors can diversify their portfolio by, for instance, investing $10,000—something historically challenging due to extensive paperwork, associated costs, and time constraints. The enhanced liquidity brought about by asset tokenization further benefits investors

Shorter lock-up periods

Lock-up periods impose limitations on investors selling their assets, often resulting from the size and illiquidity of the asset. The tokenization of assets holds the promise of reducing these lock-up periods as investors can easily trade their tokens in a liquid market. In this context, investors are no longer compelled to endure extended waiting periods, allowing for quicker realization of profits or losses.

Transparent process

As the fundamental technology supporting asset tokenization, blockchain is immutable, preventing owners from altering an asset’s history to enhance its appeal. This transparency empowers investors to access the complete history of a holding, facilitating more informed decision-making.

Secure identity

With ownership and decentralized identity (DID) details kept on the blockchain, a buyers’ private-public key pair forms a digital signature ensuring it’s really them — this can be used for things like KYC / AML verification. Additionally, there are DID identifiers decided upon by standards organization, such as w3c, ensuring acceptance across many different networks and platforms.

Future of Asset Tokenization

Tokenization stands as a transformative force set to reshape the landscape of contemporary asset management. With its core principles rooted in democratizing access to markets and ensuring both fairness and security, tokenization opens up new horizons for a broader spectrum of investors. However, navigating this promising terrain is not without its challenges, primarily anchored in legal boundaries.

The extent of this hurdle varies based on the nature and regulatory landscape of the asset earmarked for tokenization. As we embark on this journey, overcoming legal considerations will be integral to unlocking the full potential of tokenization and realizing its profound impact on the accessibility, fairness, and security of asset management practices.

Conclusion

Primary as an AI-managed multi-asset platform opens up with its infrastructure new opportunities for banks, neo-banks, broker-dealers, asset managers, alternative investment industries, such as real estate, tech secondaries, carbon and music, art and collectibles as well as retail investors.

In essence, the introduction of Primary as an AI-managed multi-asset platform not only provides a groundbreaking infrastructure but also presents a spectrum of possibilities for various sectors, fostering innovation and accessibility for a diverse range of participants, including institutional players and individual retail investors alike